Recently, Precious Metals bullion dealer Monex ran themselves into quite the pickle.

According to the L.A. Times, Monex defrauded thousands of customers through an illegal scheme that used high-pressure sales tactics and left many elderly clients with no life savings. Monex would take a small down payment and use that money to purchase a lot more silver or gold than they could actually afford. This model became a nightmare in a declining market.

Monex was leveraging the price of metal and "locking" in their clients to a payment program that would only be feasible if the market continued to rise. This was and is a very risky venture and would essentially put the consumer/investor into a financial obligation for the foreseeable future.

Funny enough, in 1977 Canada's Supreme Court ruled against Monex's founders for doing exactly that. Then operating as Pacific Coast Coin Exchange, they had some 90% of their coin sales on margin. Imagine buying a house at the market peak and a recession rolls through. Making payments on gold or silver at a lower price for the foreseeable future is not a wise investment to make. A responsible investor will buy metal with the cash they have on hand.

Monex isn't the only California bullion dealer to face complaints or judgements.

In 2012, Santa Monicas' Goldline International settled with California courts on a 19-count criminal fraud complaint. According to an ABC News Investigation, Goldline persuaded buyers to purchase collectible coins instead of Gold and Silver Bullion. This switch allowed Goldline to add a much larger sales mark-up but made the investment much less lucrative.

If you think history tends to repeat itself, it usually does. Again in 2015, Seacoast Coin, Inc., formerly doing business as Merit Financial and Merit Gold and Silver obtained a $2 million court judgement from the Santa Monica City Attorneys Office. This case, similar to Goldlines' 2012 case, was in regard to misleading consumers to purchase gold and silver bullion at a much higher premium because they were considered collector coins.

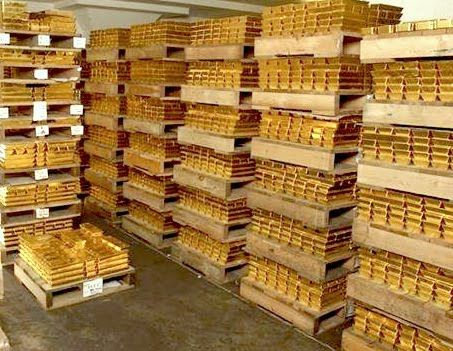

So how do we ensure to purchase gold and silver bullion responsibly? Well let's think about the essentials to purchasing gold and silver. First and foremost, Gold and Silver needs to be liquid.

In order for Gold and Silver to be liquid, it needs to carry a few characteristics.

1. Minimum Purity:

Fine Gold should have a minimum purity of 99.99%. Fine Silver should have a minimum purity of 99.9%.

2. LBMA/ COMEX Accreditations:

The London Bullion Market Association (LBMA) and The Commodity Exchange. These accrediting bodies enable precious metals to have the acceptance around the world (LBMA) and domestically in the United States (COMEX). These standards are awarded to refineries around the world. These refineries have their metal listed as "responsible" and "good" to trade. Fine gold and silver without the LBMA or COMEX designation often times does not allow the metal to trade for as good as a price. For instance, if you see the spot price of gold and silver, in an ideal world, you would like to sell your metal for that spot price. Depending on market demand, if there is no secondary market for an unaccredited bar or coin, these precious metals will eventually need to go back to an LBMA Refinery. There they would be recast into a product with the proper approved logo.

3. Low premium:

To ensure that either the gold and silver you purchase will be able to be sold to as close as the current spot market, you need to ensure you purchase metal with a low premium. This low premium should be on gold and silver the has all the correct accreditations as stated above.

Once all three of the above have been utilized, you have ensured that you are making a wise, educated gold and silver bullion purchase.

So is there problem with more expensive collectible coins?

It depends. This can be tricky. Yes, some collectible coins carry demand and have a numismatic value. Some do momentarily and six months from the time you purchase it, the demand wanes and you can't make up the difference of the price you bought it for.

Bottom line: This could be a gamble in terms of choosing an investment. If you do choose to go down the path of a higher premium collectible coin, make sure you do all your research before such purchase.

So how do you ensure that you are buying the correct precious metals bullion products?

Global Bullion Suppliers only sells LBMA branded precious metals bullion. Other sites will have thousands of different products and brands. Global Bullion Suppliers is focused on only selling products to help build your precious metals investment portfolio at the lowest cost in Canada. GBS sells both Gold and Silver that will check off each requirement you will have. Prices are low, fair, and direct from an LBMA / Comex Refining or Minting facility.

So next time you decide to make a precious metals bullion investment, make sure you do it responsibly.